By Aly J. Yale for WSJ

Shopping for a home is fun. But before you start honing in on your perfect neighborhood or architectural style, you want to make sure you are on firm financial footing. That means figuring out your price range.

“The most common mistake I see is buyers going to look at a house, falling in love with it, and then trying to get their budget and income to match their desires,” says Jay Garvens, business manager at Churchill Mortgage in Colorado Springs, Colo. “You’re essentially just setting a trap for yourself.”

Still, knowing what you can afford can be challenging—particularly when mortgage rates are volatile, as they are now. Even small changes in interest rates can make a big difference in monthly payments and, subsequently, your price range. (Truly: A half-point jump in rates can shave tens of thousands off your budget).

For this reason, it’s best to start with the monthly payment you can afford—and then work backward from there. Once you know this number, you can quickly calculate your shopping budget if conditions change.

“It all boils down to what payment you feel comfortable with,” says Seth Bellas, branch manager at Churchill Mortgage in Grand Rapids, Mich. Are you preparing to buy a house? Use these strategies to set an accurate home buying budget before you start.

Strategies for setting your home budget

There are a few approaches you can take to set your home purchase budget. To start, you’ll need an accurate idea of how much money you earn each month, as well as what your monthly bills look like.

The next step is to figure out how much there is left over that can be directed toward a mortgage and other housing costs. Below are some popular rules of thumb to help you get started. (Although keep in mind these aren’t meant to be substitutes for making a detailed budget.)

The 28/36 method

The 28/36 method is one of the most commonly used home budgeting strategies, as it closely ties in with how mortgage lenders qualify borrowers.

Though lenders look at many financial factors when considering an application. One of the most important is your debt-to-income ratio, or DTI, which represents the share of your monthly income that goes to your various debt payments.

Exact DTI requirements vary by loan program, but in most cases, lenders prefer a front-end debt-to-income ratio of 28% or less—meaning your existing debt payments (credit card bills, car loan payments, student loan payments, etc.) can’t take up more than 28% of your monthly pre-tax income.

On top of that, they also usually require a back-end DTI of 36% or less. This means your existing debt payments—plus your new mortgage payment—should be 36% or less of your monthly income.

Here’s an example of how using the 28/36 DTI ratio can help you set your monthly budget. Say you earn $8,000 per month, meaning you’d want to keep your total debt payments to no more than $2,800, or 36% of the total. Say, you already have a car payment of $500 and a student loan payment for $100—amounting to about 7% of your budget. This would leave you $2,200 left for a potential mortgage payment.

The triple-your-salary method

Another popular method for setting your house-hunting budget is to take your gross annual income and multiply it by three. This typically results in a payment that’s well under a third of your monthly pay.

So under this method, if you bring in $120,000 a year (before taxes), you could potentially set your budget at $360,000. Once you have that number, you can then use a mortgage calculator to plug in current interest rates and determine what your monthly payment might be.

Just keep in mind: This method doesn’t factor in the other monthly debts and expenses you’re dealing with. For this reason, you may want to calculate your budget using both the 28/36 method and this one—just to be safe.

Consider your down payment and closing costs

Your down payment plays an important role when setting your home buying budget, and that’s because the more you put down on a home, the lower your mortgage balance will be and, subsequently, the lower the payment.

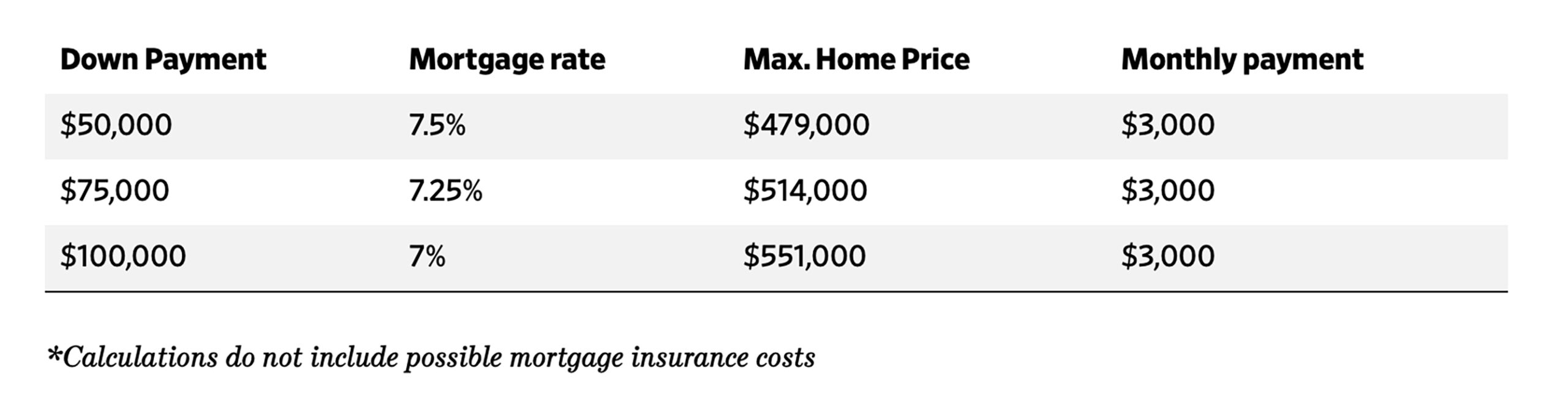

Larger down payments can often qualify you for lower interest rates, too. How big can the effect be? The table below shows three potential price ranges for a buyer with a $3,000 a month budget, based on different down payment amounts:

A note of caution: While a larger down payment can give you a bigger budget to work with, you don’t want to spend all your savings on your down payment, since you’ll have plenty of other expenses, especially closing costs, to cover too. “One mistake I see people make is they under-budget for closing costs,” says Rob Randels, a financial and wealth advisor at Northwestern Mutual Private Client Group in Omaha.

Closing costs vary based on location, loan size, lender and other factors, but typically, you can expect them to run between 2% and 6% of your loan amount. Your lender should give you a loan estimate that details your expected closing costs when you get preapproved.

Use a mortgage calculator

After you settle on a rough budget using one or all of these methods, use a mortgage calculator to keep track of how changing mortgage rates might impact your spending power.

These tools factor in current rates, your loan amount and loan term, home insurance costs and more and can help give you an accurate picture of what your monthly payment may look like at any given price range. You can then judge what fits into your household budget best.

What impacts your monthly payment

Once you know what you can afford to spend, understanding what goes into a mortgage payment can also help you use that budget wisely.

In addition to the price of a home and the down payment you offer, these factors also influence your monthly mortgage:

- Your mortgage length. Shorter-term mortgages (15-year loans, for example) come with higher monthly payments than longer-term ones (say, your standard 30-year loan), because they spread your balance out across fewer months. Though the spread between rates on these loans varies, the average difference between 15- and 30-year loan rates was 0.7 percentage points between January and November 2023.

- Your mortgage rate. Mortgage rates are influenced by larger economic factors (such as investment activity and actions by the Federal Reserve). However, the rate you get will also depend on the mortgage lender and loan program you choose, as well as your financial profile. Borrowers with 760 credit scores or higher usually get the best rates (and with a score under 580, you’ll have a hard time qualifying at all).

- Whether you need mortgage insurance or not. There is also the possibility that you’ll need to pay for mortgage insurance that could get added into your payment. Mortgage insurance is required on FHA loans and some conventional loans if you make a down payment of 20% or less. On FHA loans, you’ll pay anywhere from 0.45% to 1.05% of the loan amount annually, spread across your 12 mortgage payments. With conventional loans, it’s $30 to $70 per month for every $100,000 borrowed.

- Your escrow costs. Your estimated home insurance premiums and property taxes for the year are added to your mortgage payment on top of your required principal and interest payments. These costs can vary widely by location, the size of your house and other factors.

How to increase your home-buying budget

If your calculations have you feeling limited, there are ways you can potentially afford a bigger house. First, work on your credit score. Higher credit scores typically qualify you for lower mortgage rates, which can help expand your buying budget while keeping your monthly payment in check. For the best rates, aim for a 760 credit score or higher.

Comparing mortgage lenders is another savvy way to increase your budget. Lenders tend to vary in rates and fees, so getting a few quotes will allow you to get the lowest interest rate and payment possible, given current market conditions.

Finally, you can also work on saving up more cash before your home purchase. Not only will this allow you to make a larger down payment—and therefore borrow more—it may get you a lower interest rate as well.

It will also give you a solid emergency fund. Most experts recommend budgeting for at least 1% to 4% of your home’s value for repair and maintenance costs each year.

Leave a Reply